Advanced Celigo Flows: Streamlining Finance & Accounting

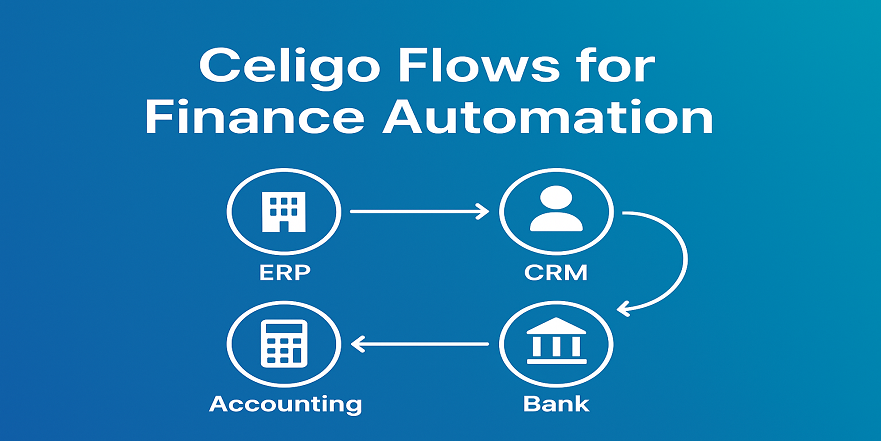

Managing finance and accounting functions efficiently is critical for business success. Advanced Celigo Flows: Streamlining Finance & Accounting helps automate and optimize financial data synchronization between ERP, CRM, and other cloud applications. By leveraging these advanced flows, finance teams can eliminate redundant manual tasks, improve accuracy, and maintain real-time visibility into their financial health.

Through Advanced Celigo Flows: Streamlining Finance & Accounting, organizations can seamlessly connect systems like NetSuite, QuickBooks, and Salesforce, ensuring that every transaction is accurately reflected across all records from invoices to revenue recognition. This level of automation not only saves time but also strengthens compliance and audit readiness.

Key Benefits of Advanced Celigo Flows for Financial Management

The Advanced Celigo Flows: Streamlining Finance & Accounting approach enhances operational efficiency in several ways:

- Automated Data Syncing: Ensures continuous synchronization between ERP and financial tools, eliminating data silos.

- Improved Accuracy: Reduces human error in reconciliation, billing, and reporting.

- Enhanced Compliance: Maintains a clear audit trail with real-time financial data.

- Faster Reporting: Delivers up-to-date reports for financial forecasting and decision-making.

- Scalable Automation: Handles complex workflows as businesses expand their financial operations.

According to Celigo’s official documentation, these flows can automate 90% of accounting-related data transfer between NetSuite and connected apps, making them ideal for growing enterprises.

How Advanced Celigo Flows Simplify Accounting Workflows

When it comes to Advanced Celigo Flows: Streamlining Finance & Accounting, automation covers key processes such as:

- Invoice and Payment Syncing: Automatically pushes invoice data between systems like Shopify, Amazon, or Salesforce to NetSuite.

- Expense Management Integration: Connects expense tools (like Expensify or Concur) for seamless reimbursement tracking.

- Bank Reconciliation: Matches transactions automatically, saving hours of manual verification.

- Revenue Recognition Automation: Ensures compliance with ASC 606 and IFRS 15 standards.

- Multi-Entity Consolidation: Consolidates data across subsidiaries for unified financial reporting.

Each of these workflows helps in streamlining finance and accounting operations, ensuring data accuracy and faster closing cycles.

Why Choose Celigo for Financial Process Automation?

Advanced Celigo Flows: Streamlining Finance & Accounting stands apart due to its flexibility and scalability. Celigo’s Integration Platform (iPaaS) supports both standard templates and customizable flows tailored for unique business needs.

Core Advantages Include:

- Prebuilt integrations for popular apps like NetSuite, QuickBooks, and Xero.

- Low-code interface suitable for both IT and finance teams.

- AI-powered error handling and monitoring.

- Real-time alerts to ensure workflow continuity.

- Compatibility with REST and SOAP APIs for enterprise-grade integration.

For more insights, visit Celigo’s iPaaS overview page.

Impact of Advanced Celigo Flows on Financial Decision-Making

With Advanced Celigo Flows: Streamlining Finance & Accounting, CFOs and finance leaders gain better control over their financial ecosystems. The real-time data flow ensures accurate dashboards, budget tracking, and KPI measurement. It reduces the financial close period by automating inter-company transactions and reconciliations.

This data-driven approach supports proactive decision-making, enabling companies to allocate budgets efficiently, forecast accurately, and minimize operational costs.

Future of Finance Automation with Celigo

As financial processes become increasingly data-driven, Advanced Celigo Flows: Streamlining Finance & Accounting will continue to evolve with AI and machine learning enhancements. Predictive analytics, anomaly detection, and intelligent approvals will further redefine how organizations handle finance automation.

Businesses adopting such technology will gain a competitive advantage through improved transparency, agility, and compliance readiness.

Implementation Best Practices

To successfully deploy Advanced Celigo Flows: Streamlining Finance & Accounting, follow these steps:

- Conduct a full audit of current manual finance workflows.

- Map critical integration touchpoints between ERP and accounting software.

- Use Celigo’s prebuilt templates for faster implementation.

- Monitor performance dashboards regularly to detect sync issues.

- Continuously optimize automation flows based on business changes.

Following these best practices ensures smoother operations and maximum ROI from Celigo’s advanced flows.

Call to Action :

Transform your finance and accounting operations with Advanced Celigo Flows: Streamlining Finance & Accounting. Simplify data management, reduce manual errors, and achieve end-to-end automation that scales with your growth.

Contact Tech i-vin Technology your trusted partner in Celigo and NetSuite integration to explore how automation can revolutionize your financial ecosystem.